How the FATF Guidelines Impact the Global Crypto Industry Things To Know Before You Get This

Getting through the Challenges of Executing FATF Guidelines for P2P Cryptocurrency Transactions

Cryptocurrencies have obtained significant appeal in recent years, providing a decentralized and borderless substitute to conventional financial systems. Peer-to-peer (P2P) cryptocurrency deals, in certain, have become increasingly common as they allow people to negotiate directly with one one more without the need for middlemans.

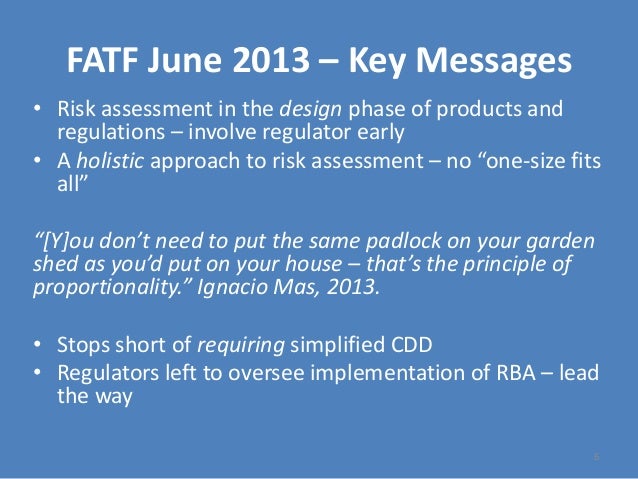

However, as cryptocurrencies proceed to develop, regulators are dealt with with the obstacle of making sure that these electronic properties do not ended up being a place for money laundering and terrorist money management. To attend to these concerns, the Financial Action Task Force (FATF), an intergovernmental organization focused on combating amount of money washing and terrorist financing, has introduced rules primarily striven at P2P cryptocurrency transactions.

Executing these standards presents a number of difficulty for each services functioning in the cryptocurrency area and regulative authorities. In this post, we are going to check out some of these challenges and go over potential solutions.

1. Lack of Quality:

One of the main challenges in carrying out FATF guidelines is the absence of quality surrounding specific parts of the guidelines. Cryptocurrencies function on blockchain modern technology, which supplies pseudonymous deal documents rather than directly recognizable information. This generates challenges in identifying who is entailed in a purchase and validating their identifications.

To overcome this difficulty, companies included in P2P cryptocurrency transactions need to carry out robust Understand Your Customer (KYC) treatments to make sure conformity along with anti-money washing (AML) requirements. These treatments may involve accumulating extra info coming from customers such as proof of handle or administering thorough background checks.

2. Privacy Issues:

While KYC measures are vital for stopping illegal activities, they also raise personal privacy issues among cryptocurrency customers who value privacy. Numerous individuals opt for cryptocurrencies exactly because they give higher personal privacy reviewed to conventional financial units.

To attack a equilibrium between personal privacy and regulatory observance, services may look into modern technologies that make it possible for for enhanced personal privacy while still pleasing AML demands. For Another Point of View , zero-knowledge evidence and secure multi-party computation permit confirmation of purchase information without uncovering vulnerable individual details.

3. Decentralized Swaps:

P2P purchases are often helped with via decentralized swaps (DEXs), which work without a central authority. These systems permit customers to trade cryptocurrencies directly along with each other, further making complex the implementation of FATF tips.

To take care of this challenge, governing authorizations can easily work very closely along with DEX drivers and promote them to use AML plans and treatments voluntarily. Also, enhanced collaboration between regulators and DEXs may assist cultivate technological remedies that allow compliance without endangering the essential concepts of decentralization.

4. Cross-Border Transactions:

Cryptocurrencies are borderless through nature, producing it effortless for individuals to interact in cross-border purchases. However, this also postures obstacle for executing FATF guidelines as various jurisdictions may have varying regulatory demands.

To navigate this obstacle, international cooperation one of governing body systems is essential. Blending rules across jurisdictions can enhance observance efforts and ensure a consistent approach to combating amount of money laundering and terrorist money management in P2P cryptocurrency purchases.

In final thought, applying FATF standards for P2P cryptocurrency purchases presents many obstacle that need to be attended to through both businesses functioning in the cryptocurrency space and regulative authorizations. Through embracing innovative modern technologies, striking a harmony between privacy and observance, teaming up along with decentralized exchanges, and advertising worldwide cooperation, these problem can be conquered effectively. Simply through practical solution may we guarantee the long-term viability of cryptocurrencies while mitigating risks connected along with loan washing and terrorist money management.